Story at-a-glance

- Dentists rely on exact skills like hand control and clear vision—small changes can end a career.

- Generic disability insurance isn’t enough for the physical demands of dental practice.

- Own-occupation coverage is key—so you’re eligible to be paid even if you do non-clinical work.

- Practice owners need overhead coverage to keep the business running while disabled.

- Waiting risks coverage—get protected while you’re still healthy.

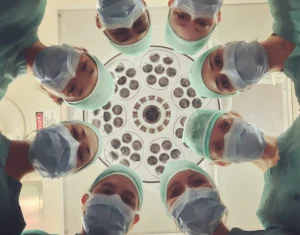

In the technically demanding world of dentistry, your livelihood depends on an extraordinary combination of manual dexterity, visual acuity, and physical stamina. Unlike many healthcare providers who could transition to consultative roles, your income is fundamentally tied to specific physical abilities that face unique threats. Here’s why disability insurance for dentists needs to be custom-designed for the distinctive vulnerabilities of dental practice.

The Specialized Risks of Dental Practice

Dentistry creates disability exposures unlike other healthcare fields:

Microsurgical Precision and Hand Stability

Your practice fundamentally depends on submillimeter precision and exceptional hand control. Even minor tremors, nerve injuries, or arthritic changes that would be inconsequential in other fields can immediately render dental procedures impossible. The extraordinary specificity of dental motor skills means conditions that would barely impact daily life can completely end your clinical career.

Musculoskeletal Vulnerability from Positioning

The ergonomic challenges of dental practice create extraordinary vulnerability to specific musculoskeletal disorders. Hours spent in standardized working positions—often twisted and leaning—places tremendous strain on the neck, shoulders, and back. Studies show that over 70% of dentists develop musculoskeletal pain during their careers, with many forced to reduce their clinical hours or retire early.

Visual Acuity and Depth Perception

Dental procedures require exceptional visual discrimination at close range. Even minor changes in visual acuity, contrast sensitivity, or depth perception can substantially impact clinical safety and efficiency. The visual demands of distinguishing subtle shade variations, identifying small structural defects, and maintaining precise margins create vulnerability to visual changes that might remain manageable in other contexts.

Repetitive Stress Injuries

The repetitive nature of dental procedures—thousands of similar hand movements weekly—creates heightened vulnerability to carpal tunnel syndrome, tendonitis, and other repetitive stress injuries. These conditions directly impact the procedural efficiency that drives practice profitability, often forcing practice modifications long before affecting general hand function.

Physical Stamina and Postural Endurance

Dental procedures require maintaining specific positions for extended periods while performing precise manipulations. Spinal conditions, disc disease, or other disorders affecting postural endurance can progressively limit the ability to maintain a full schedule of procedures—directly impacting income potential.

Why Standard Coverage Falls Short for Dentists

Generic disability insurance typically contains significant limitations for dental practice:

- Definitions of disability that inadequately address the specific technical skills of dentistry

- Insufficient protection for the unique physical demands of clinical practice

- Inadequate recognition of the distinction between general dentistry and specialized procedures

- Insufficient coverage for practice overhead during disability periods

- Rehabilitation benefits inadequate for the specialized nature of dental practice

Essential Disability Insurance Elements for Dentists

True Own-Occupation Definition

As a dentist, you need a policy with an “true own-occupation” definition of disability. This ensures you’ll be eligible to receive full benefits if you can’t perform clinical dentistry—even if you could work as a dental consultant, educator, or in another capacity.

Financial Strength You Can Trust

Select insurers with exceptional financial strength ratings (Comdex score of 90+) and mutual ownership structures where policyholder interests come first. A disability claim could span decades—financial stability ensures the company will fulfill its obligations throughout your claim period.

Practice Overhead Protection

For practice owners, business overhead expense coverage is essential alongside personal disability protection. This specialized coverage maintains your practice during disability periods, covering staff salaries, rent, and fixed expenses while you recover.

Dentistry-Specific Features

Prioritize these critical policy elements:

- Protection for the highly specialized procedural aspects of dental practice

- Residual disability benefits that recognize reduced procedural capacity or efficiency

- Future insurability options that protect practice growth potential

The Financial Reality at Stake

The financial implications are substantial. A 38-year-old dentist with an established practice earning $300,000 annually could lose over $8.4 million in lifetime earnings if permanently disabled. Yet many dentists hesitate at disability insurance premiums of $350-$600 monthly—significantly less than investments in clinical equipment and practice technology.

Consider this scenario: If subtle hand tremors affected your ability to perform crown preparations, or if cervical disc disease made maintaining proper positioning during lengthy procedures impossible, how would you maintain your financial trajectory? What alternative career path could replace your current income without requiring the specialized clinical skills that define dental practice?

The Practice Investment Factor

Unlike employed physicians, most dentists build practices representing substantial capital investment beyond their clinical skills. This practice equity—often valued at 60-80% of annual collections—represents additional financial exposure during disability. Specialized coverage that maintains practice viability during disability periods protects both current income and this substantial practice equity investment.

Making the Right Policy Selection

When comparing disability policies, dentists should focus on these key differentiators:

- Definition of disability specific to your unique occupation

- Technical skill protection without excessive limitations

- Financial strength ratings of the insurance carrier

- Inclusion of business overhead coverage for practice owners

- Coverage for occupation-specific technical functions

Many dentists find that investing in premium coverage from top-rated carriers provides essential security. The difference between standard and specialized coverage could mean the difference between maintaining your lifestyle and facing significant financial adjustment after disability.

Secure Your Future Today

The optimal time to secure disability insurance is now—while you’re healthy and before any practice-related physical symptoms develop that could limit your coverage options. Many dentists delay this protection until early musculoskeletal symptoms emerge—when it’s often too late to obtain favorable coverage.

Request your personalized disability insurance quote comparison today by clicking the button below.

Our team specializes in disability coverage for dentists and can help you understand the crucial differences between policies that could significantly impact your future security.

Your specialized dental skills represent your most valuable financial asset—protect them with dentist disability insurance.

Frequently Asked Questions

Q: Why is disability insurance different for dentists?

A: Dentists rely on precise hand skills, posture, and vision. Even small injuries or vision changes can end their ability to practice. Regular disability coverage often doesn’t protect against these exact risks.

Q: What is own-occupation disability insurance?

A: Own-occupation coverage allows you to eligible for benefits if you can’t work as a dentist—even if you work in another job like teaching or consulting. This is important for protecting your income and lifestyle.

Q: Do dentists need practice overhead coverage?

A: Yes. Practice overhead insurance pays for your office expenses like rent, staff, and utilities while you’re disabled. It helps keep your practice running while you recover.

Q: What features should dentists look for in a policy?

A: Look for true own-occupation coverage, strong carrier financial ratings, and options for future coverage increases.

Q: When should I get disability insurance as a dentist?

A: The best time is while you’re healthy. Waiting until symptoms appear can limit your options or lead to exclusions in your policy.

Ready to protect your future?

Get a personalized side-by-side policy comparison of the leading disability insurance companies from an independent insurance broker.