Story at-a-glance

- Market timing and stock picking rarely work—many physicians learn the hard way that these strategies add risk and reduce returns.

- Diversification helps reduce volatility by spreading risk across asset classes, sectors, and global markets.

- Proper diversification includes more than just stocks and bonds—think real estate, commodities, and international exposure.

- Global investing reduces concentration risk—limiting your portfolio to North America means missing half the world’s market opportunities.

- Qualified retirement plans now offer easy access to diversified options, including low-cost ETFs and index funds covering nearly every asset class.

As with too many retirement savers, it took two stock market crashes (2001, 2008) and a global financial crisis for Randy Page, M.D. to finally realize that trying to time the market or pick specific stocks or sectors is a costly exercise in futility. But, with the value of his qualified retirement plan nearly halved in the 2008 crash, Randy also recognized that he could not afford to avoid equities if he was going to have any chance of meeting his retirement goal. That’s when he learned that the time-tested, academically-based principle of diversification is the key to long-term growth for physician retirement plans.

“In 2001 and 2008 I not only sold at the wrong time (near the market bottom), I bought at the wrong time (near the market top). It was an expensive lesson to learn that no one can predict with any level of certainty the direction of the market. To make matters much worse, I had tried to bet on just a couple of specific sectors of the market which only compounded my risk.”

Fortunately for Randy, his time horizon is still long enough and his earnings as a physician are still growing which will enable him to rebuild his capital and benefit from steady long-term returns. This time, his focus will be on managing the risks, which are more certain, rather than investment performance which is much more difficult to control. With a properly diversified portfolio, he has a much better opportunity to capture returns wherever they occur while mitigating the risk of any one particular investment.

What is Proper Diversification?

The key to proper diversification is recognizing that different assets and all of the subsets of assets have varying ranges and patterns of volatility. For example, equities as a whole as measured by a broad index (Russell 3000) are less volatile than any one subset of equities as measured by a narrow index (S&P Mid Cap 400). And, because stocks and bonds represent only a portion of available asset classes, diversification today must include a broader mix of assets such as precious metals, commodities, currencies, real estate and their subsets. Because of the fundamental economic relationship between risk and return an investor’s selection of asset mix, rather than the performance of any one asset, has the primary impact on that investor’s long-term investment returns.

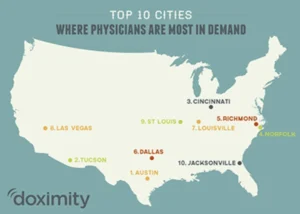

The Importance of Global Diversification

Most investors are surprised to learn that North American companies represent slightly more than half of the world’s developed equity market (based on market capitalization) and far less than half of the global economy. Investing solely in the North American markets is, therefore, just as risky as investing in half of the sectors that comprise the S&P 500. In essence, you expose your portfolio to more volatility and risk when you invest solely in the North American markets, and you certainly miss the opportunities for the returns that are available in the global markets.

Qualified Retirement Plans Offer Diversification Opportunities

Creating a properly diversified portfolio in qualified retirement plans, such as IRAs, 401k and 403b plans, has been made much more achievable with the availability of a broader range investment options. It’s now possible to invest in broad cross sections of the world’s stock markets through exchange-traded funds (ETF) which are also low cost alternatives to actively managed mutual funds. Most sectors of the economy are represented by index funds or ETFs for easy access based on your desired mix of assets. Commodities and real estate index funds also provide access for small investors seeking even broader diversification.

Ready to protect your future?

Get a personalized side-by-side policy comparison of the leading disability insurance companies from an independent insurance broker.