✅ No Medical Exam Required

✅ Discounts Up to 30% Off

✅ Coverage That Protects Your Future Income

🔹 Get Your Personalized Quotes in 30 Seconds 🔹

Unbiased, Side-by-Side Comparisons from the Best Insurers

Not all disability insurance is created equal. That’s why we compare top-rated providers to help you find the best coverage at the lowest price. Since we’re not tied to any one company, our recommendations are always in your best interest.

Fast, Simple, and Hassle-Free – Get a Quote in 60 Seconds

You’re busy. We get it. That’s why we’ve made getting a quote as easy as possible. No long forms, no paperwork—just a few quick details, and you’ll instantly see your best disability insurance options in under a minute.

No Sales Pressure – Just Transparent Comparisons

We know you don’t have time for a pushy sales pitch. That’s why our process is zero-pressure and no-obligation. You get clear, side-by-side comparisons of the best disability insurance options for doctors—so you can make the best choice at your own pace.

REQUEST QUOTES BELOW TO LOCK IN YOUR RATES

Here’s What You’ll Get When You Request Quotes

We Will Create a Quote Comparison Specifically For You

We create a fully personalized quote comparison based on your age, medical specialty, income, and location to find the best disability insurance options for you. We also identify exclusive discounts available through your residency program, ensuring you get the best coverage at the lowest cost.

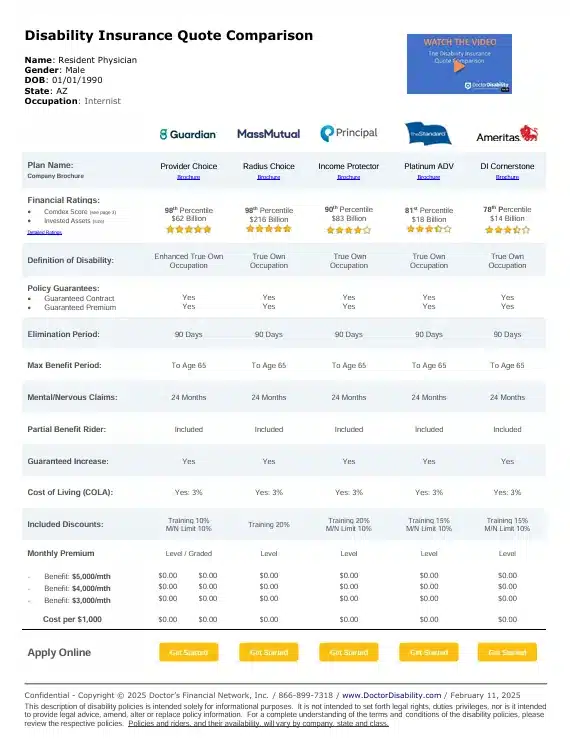

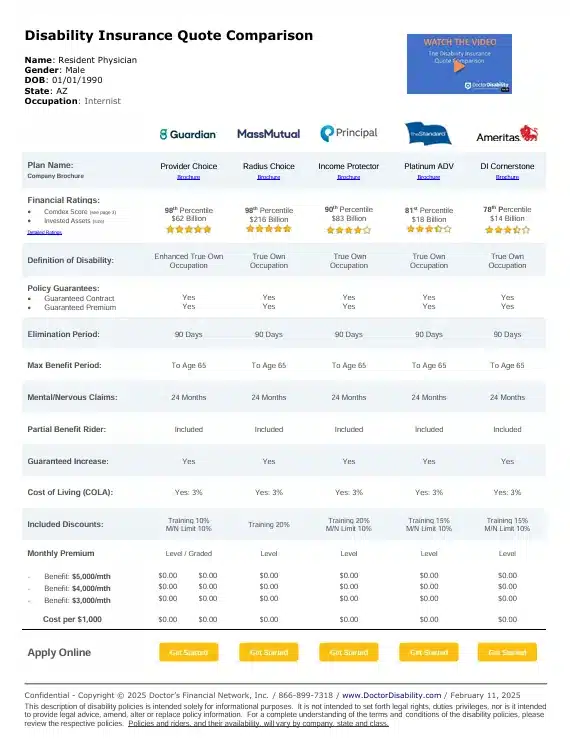

Compare Top Disability Plans for Residents

We compare the top five disability insurance companies side by side, breaking down pricing, coverage, and key benefits. Our analysis highlights policy differences and exclusive discounts, so you can confidently choose the best protection for your future earnings.

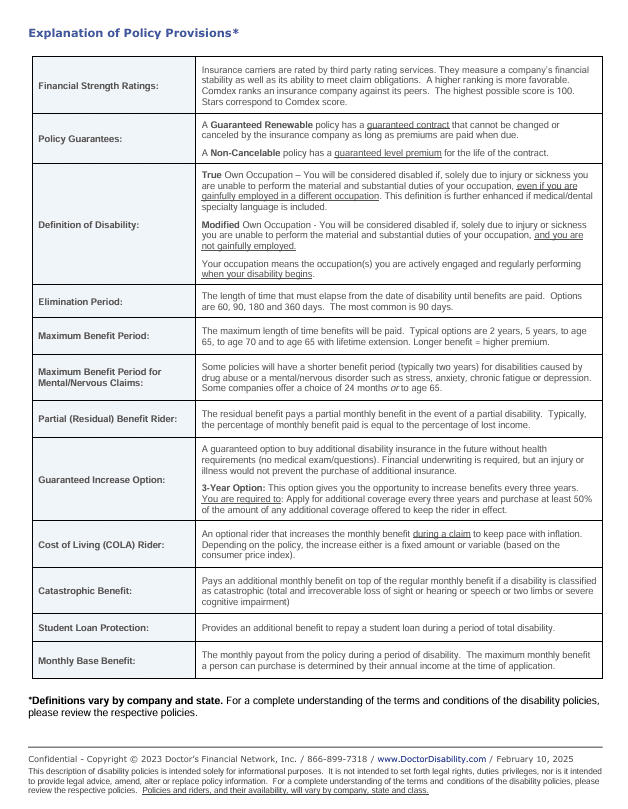

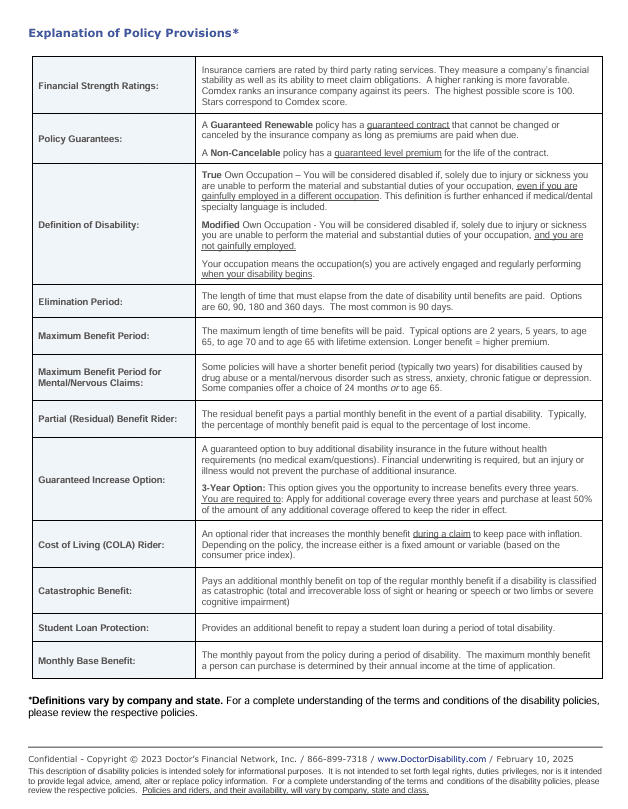

We'll Explain Everything, Removing the Guesswork

We break down every policy provision in simple terms—no jargon, no confusion. Understand exactly what’s covered, what’s not, and how each feature impacts you, so you can make a confident, informed decision without second-guessing your choice.

Apply in 15 Minutes or Less

Once you choose the best policy, we streamline the application process so you can apply in 15 minutes or less. No hassle, no paperwork headaches—just a fast, efficient way to lock in your coverage and protect your future income.

Here’s What You’ll Get When You Request Quotes

Quotes Personalized To You

We create a fully personalized quote comparison based on your age, medical specialty, income, and location to find the best disability insurance options for you. We also identify exclusive discounts available through your residency program, ensuring you get the best coverage at the lowest cost.

Compare Top Disability Plans for Residents

We compare the top five disability insurance companies side by side, breaking down pricing, coverage, and key benefits. Our analysis highlights policy differences and exclusive discounts, so you can confidently choose the best protection for your future earnings.

We'll Explain Everything, Removing the Guesswork

We break down every policy provision in simple terms—no jargon, no confusion. Understand exactly what’s covered, what’s not, and how each feature impacts you, so you can make a confident, informed decision without second-guessing your choice.

Apply in 15 Minutes or Less

Once you choose the best policy, we streamline the application process so you can apply in 15 minutes or less. No hassle, no paperwork headaches—just a fast, efficient way to lock in your coverage and protect your future income.

ABOUT OUR FOUNDER

Chuck Krugh is a highly accomplished and experienced financial professional, with a deep understanding of the financial needs and goals of physicians and dentists. He is a Certified Financial Planner (CFP), Chartered Life Underwriter (CLU), and Chartered Financial Consultant (ChFC). Chuck is also an entrepreneur, and the founder and CEO of Doctor Disability, where he and his team have helped over 20,000 physicians and dentists find disability insurance.

Chuck’s personal experience with the importance of disability insurance, shaped his mission to provide financial security for his clients. As a child, Chuck’s father suffered a major heart attack and was never able to return to work. Thankfully, his family was covered by disability insurance which provided the income they needed to survive financially. This experience motivated Chuck to ensure that others have the same protection and security for themselves and their families.

Join Over 25,000+ Physicians

FAQs

- Convenience – We make shopping for and purchasing disability insurance easy. Request quotes on-line or over the phone, review them on your schedule with one of our experts and apply on-line.

- Get the Best Policy at the Best Price – No need to call multiple companies, no need to meet with multiple agents. Receive a side-by-side comparison of the best plans from the top companies so you can quickly decide on the most appropriate policy.

- Specialization – We are experts in disability insurance for doctors and only work with physicians and dentists.

- Nationwide Presence – We’re licensed everywhere and will continue to service your account if you should move to a new area. Most agents are only licensed in one state.

- Excellent Customer Service – Your experience with Doctor Disability just begins when you purchase a policy; our goal is to provide excellent service for as long as you maintain your disability policy.

No, the cost of a policy is the same whether you buy it directly from the insurance company, or use a broker like Doctor Disability. Because of our high volume, in many cases our price is less than going directly through the insurance company.

The cost of the policy will depend on many factors:

- Does the policy consider you disabled if you can’t work in any occupation, or if you can’t work in your occupation?

- Is the policy non-cancelable and guaranteed renewable, or can the insurance company raise the premium or cancel your policy?

- The financial strength ratings of the insurance company?

- Your Gender

- Your Health

- Your Occupation (policies covering specialties with invasive procedures will cost more)

- Optional benefits added to the policy such as inflation protection or partial benefits

You can expect to pay anywhere from one to four percent of your annual gross income for a non-cancelable, guaranteed renewable policy. With disability insurance, you get what you pay for (cheaper does not mean better – like parachutes and brain surgeons).

Because premium and policy eligibility are based on age and health status, the best time to buy a disability policy is when you’re young and healthy (probably today!). Pre-existing conditions are typically not covered and serious medical conditions can preclude a person from obtaining coverage.

Group Long Term Disability Insurance

- Benefits are taxable if your employer pays the premium

- Benefits based on a percentage of base income. Bonus and commissions are typically not covered

- Benefits typically reduced during a period of disability if you receive benefits from another source or work in a different occupation

- More restrictive definitions within the policy (qualification for benefits may require you to be unable to work in ANY occupation)

- No rate guarantees

- Partial disability may not be covered

- Policy can be changed or canceled by the insurance company or your employer at any time

- Policy is connected to the employer and generally not portable

Individual Disability Insurance

- You receive benefits tax-free if you pay the premium

- Quality plans will cover you in your own occupation/specialty

- More liberal definitions within the policy to pay you more money in more claims scenarios

- Higher monthly benefits

- Benefits can increase with inflation

- Rate guarantees to age 65

- You own the policy and can take it with you to a new job or occupation

Group and association plans are less expensive because:

- They can be changed or cancelled by the insurance company

- The insurance company can raise rates in the future

- Benefits are offset by other sources of income and coverage

- Claims are paid in fewer scenarios because of the limited definition of disability

Policies can be compared based on the following criteria:

- Contractual definitions (language that determines what constitutes a disability, policy exclusions, renewability provisions, etc.)

- Contract structure (benefit period, elimination period, benefit amount, etc.)

- Policy riders (cost of living, residual benefit, future purchase benefit, etc.)

- Insurance company financial strength ratings

Disability contracts can vary greatly from company to company, which is why it is difficult to compare on price alone.

It is extremely important to find a strong, financially stable insurance company that will be able to pay your benefit should you need it. Insurance company ratings—available for most major carriers—are tools that can help you evaluate the financial strength of an insurance company.

Insurance companies are rated by five major rating services: A. M. Best (which specializes in insurance only), Fitch, Moody’s, Standard & Poor’s, and Weiss. Some of these services rate only a few hundred companies, while others rate thousands. Each service has its own criteria and philosophy for judging insurance companies. Most services base their ratings on both qualitative and quantitative factors, such as debt, claims-paying ability, investment portfolios, financial reports, and historic performance.

Each of the rating services uses a variation of an A through F scale to rate insurance companies. However, an “A” from one rating service does not necessarily equate to an “A” from another rating service. For instance, an “A” rating from A. M. Best is an “excellent” rating, while an “A” rating from Moody’s is only “good.”

Rating services stress that their ratings are not a guarantee of the financial strength of an insurer, nor are they recommendations to buy a policy or product from a particular insurer. Ratings are merely opinions based on data as interpreted by the insurance industry and financial experts. They should not be used as the sole measure of a company’s quality. Other factors, such as reputation, claims-handling procedures, and customer satisfaction, are also important.

Rating information is available from a variety of sources. The easiest way to get rating information is to contact the rating service directly, either through its website or by calling its customer service department. Most rating services provide free rating information to consumers, although you may have to pay if you need more than a few ratings. Ratings are also published in books and magazines that can be found at your local library. If you don’t want to look up the information yourself, ask your insurance agent or financial planner to do some research for you.

Contact information for the major rating services:

A. M. Best Company

Ambest Road

Oldwick, NJ 08858

Phone: (908) 439-2200

Internet: www.ambest.com

Standard & Poor’s Corporation

55 Water Street

New York, NY 10041

Phone: (212) 438-2000

Internet: www.standardpoor.com

Fitch, Inc.

One State Street Plaza

New York, NY 10004

Phone: (212) 908-0800

Internet: www.fitchratings.com

Moody’s Investors Service

99 Church Street

New York, NY 10007

Phone: (212) 553-0377

Internet: www.moodys.com

The application process is as follows:

- Click on the “Get Started” button at the bottom of your quote comparison and complete the on-line application form.

- Complete the phone interview with the insurance company. You may be asked to provide income verification and answer health history questions.

- The insurance company will review your application, health history and financial documentation.

- When your application is approved, our office will e-mail the policy to you.

- You can expect the entire process to take between 3-6 weeks.

Underwriting is the process by which an insurance company examines, accepts, or rejects insurance risks so as to charge the proper premium for the coverage. The insurance company will review:

- Past medical history (physicians seen, medication taken)

- Financial records (pay stub/tax returns – to justify the disability amount applied for)

The underwriting process generally takes three to six weeks from the time the application is sent to the insurance company. The average time is one month. Most of the time spent in underwriting is collecting information (medical records, tax returns, etc.) the underwriter needs to make an informed decision.

Depending on the benefit amount applied for, a brief medical exam may be required for the purchase of disability coverage. The exam is paid for by the insurance company and performed by a third party examination service at your home or office. The exam may include a physical exam, blood work, urine analysis and in some cases, an EKG. The results are sent directly to the underwriter for review along with the proposed insured’s application. A copy of the exam is available upon request.

How long will it take?

The medical exam will take approximately 20 to 30 minutes.

Where and when is it done?

The exam can be performed at home or in your office, Monday though Saturday.

Who does the exam?

Licensed paramedical examiners in your area complete the exam.

What is included in the exam?

A typical exam consists of height, weight, blood pressure, blood sample, urine sample, and brief medical history. With larger amounts of insurance, an EKG or treadmill test may be required.

What kind of medical history will be asked?

The examiner will ask about medications, surgeries, treatments, and other medical conditions. They will ask for the names and addresses of any doctors you have seen in the last five to ten years. To speed up the process, you will want to have this information handy.

How can I best prepare for the exam?

Blood pressure and pulse can be artificially raised by stress, alcohol, caffeine, and tobacco.

- Get a good night’s sleep the night before the examination.

- Abstain from alcoholic beverages for at least eight hours prior to the exam.

- Do not smoke or chew tobacco for at least one hour prior to your examination.

- Avoid drinking coffee, tea, or caffeinated soft drinks for at least one hour prior to your examination.

- Limit salt intake and high cholesterol foods 24 hours before your examination.

- You should not engage in strenuous physical activities 24 hours before the examination.

- Advise your paramedical examiner of any medication (including non-prescription) that you are taking.

- Have available your physicians’ names and addresses, dates of past visits, names of any prescribed medications, and any information regarding injury and major illness during the previous five years.

- If you belong to Kaiser or any other prepaid medical plan, have your medical record number available.

- Drink a glass of water an hour or so before your appointment. This will help in obtaining a urine specimen.

It depends on the type and severity of the medical problems. The insurance company has three options:

- Charge a higher premium for the policy

- Exclude the condition from the policy

- Decline insurance altogether

If you have a condition you’re concerned about, the best option may be to have Doctor Disability submit an informal inquiry to multiple insurance carriers. Just because one company denies or limits coverage, doesn’t mean they all will.

Common exclusions are:

- Mental/Nervous Disorder (sometimes companies will limit benefits to two years)

- War or Act of War

- Normal Pregnancy

- Active Military Duty

- Foreign Travel (in some policies)

- Medical Exclusion

A medical condition that existed prior to the purchase of your disability policy may be excluded from coverage. Depending on the condition, the exclusion may be permanent or temporary.

Most disability insurance does not cover “normal” childbirth. However, many will cover complications to pregnancies that prevent you from working, so long as you satisfy the policy’s elimination period (typically 90 days). If you are already pregnant, you may need to wait until you have delivered your baby and have returned to work to obtain disability insurance.

The residual benefit pays you a partial benefit in the event you suffer a partial disability. The percentage of your benefit paid is typically proportionate to your loss of income.

Most policies are priced to favor the 90-day elimination period. In many cases, the premium doubles by decreasing the waiting period to 60 days.

If your policy is non-cancelable and guaranteed renewable, the policy benefits will not change as long as you continue to pay the premium.

Most companies will allow you to see your own doctor if you are disabled. In some cases, the insurance company may require a second opinion from a doctor the insurance company selects.

Generally, if you pay your premiums with after tax dollars, your benefit is tax-free. If you deduct the premiums or your employer pays the premiums, the benefit will be taxable to you at the time of claim. Always talk to your accountant for tax advice for your unique situation.

Your employer can pay for your disability insurance coverage, but it may cause the benefit to be taxable to you at the time of claim.

Some policies will cover foreign travel. Some policies will suspend the contract while you are abroad. Speak to your agent to discuss this situation in more detail.