Story at-a-glance

- Know your loans first—check balances, interest rates, and repayment terms at studentaid.gov.

- Choose the right plan: PSLF and income-driven repayment options like SAVE or PAYE offer flexibility and potential forgiveness.

- Refinance wisely: Only consider this if you’re not using PSLF or IDR.

- Avoid lifestyle creep after your first attending paycheck—pay off debt and invest instead.

- A plan now means freedom later—take control and build long-term wealth.

Congratulations! After years of hard work, you’re about to become an attending physician. You’ve made it through medical school and residency, and now you’re finally stepping into the career you’ve worked so hard for. But there’s one thing that still lingers—your student loans.

Medical school debt can feel overwhelming, but with the right plan, you can manage it without stress and set yourself up for financial success. In this guide, I’ll break down simple, actionable steps to help you tackle your student loans with confidence.

Step 1: Know Your Student Loans

Before making a plan, you need to understand what you owe.

Here’s how to do it:

- Log into the Federal Student Aid website (studentaid.gov)

- Click on “Loan Breakdown” to see all your federal loans, interest rates, and loan servicers.

- If you have private loans, check your statements or contact your lender.

- Unlike federal loans, private loans don’t have forgiveness programs.

- Write down key details for each loan:

- Total balance

- Interest rate

- Monthly payment

- Loan servicer contact information

💡 Example: Dr. Emily finished her anesthesia residency with $250,000 in federal loans at 6.5% interest and $50,000 in private loans at 5% interest. She checked her loan breakdown and realized her federal loans qualify for income-driven repayment and Public Service Loan Forgiveness (PSLF).

Step 2: Choose the Right Repayment Plan

Your repayment plan will make or break your financial future. Here are the best options for new attendings:

Public Service Loan Forgiveness (PSLF) – If You Work for a Non-Profit

- Best for doctors working in academic hospitals, VA hospitals, or non-profit institutions.

- Make 120 qualifying payments while on an income-driven repayment plan.

- After 10 years, your remaining balance is forgiven tax-free.

📌 How to Enroll in PSLF:

✅ Submit the PSLF Employment Certification Form every year (studentaid.gov)

✅ Enroll in an income-driven repayment (IDR) plan

Income-Driven Repayment (IDR) Plans – Lower Payments While You Grow

If PSLF isn’t an option or you want to keep payments low while your salary increases, consider:

- SAVE Plan (New!) – Lower monthly payments based on income

- PAYE or IBR – Cap payments at 10-15% of discretionary income

- REPAYE (Becoming SAVE) – Provides interest subsidies

📌 How to Apply for IDR:

✅ Go to studentaid.gov

✅ Click “Apply for an Income-Driven Repayment Plan”

✅ Submit proof of income (your residency pay stub works!)

💡 Example: Dr. Jake, a pediatrician earning $60,000 in residency and $200,000 as an attending, started on PAYE. His payments were $300/month in residency. After becoming an attending, he gradually adjusted to higher payments before refinancing.

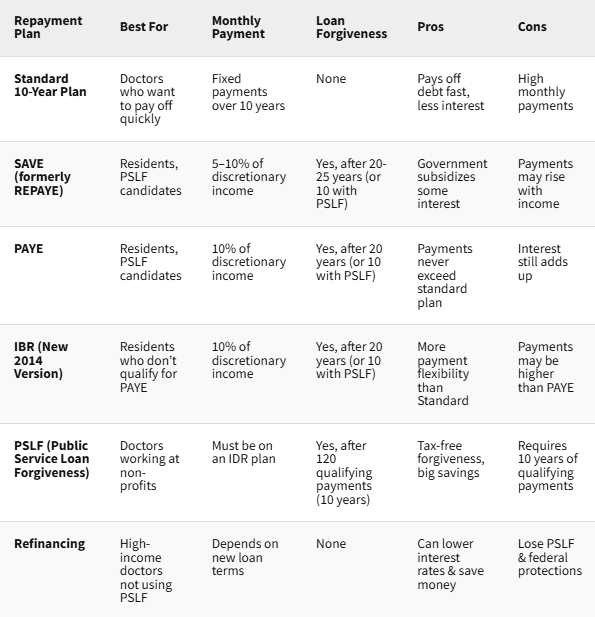

Here’s a chart comparing the main student loan repayment plans for medical residents and graduates:

| Repayment Plan | Best For | Monthly Payment | Loan Forgiveness | Pros | Cons |

|---|---|---|---|---|---|

| Standard 10-Year Plan | Doctors who want to pay off quickly | Fixed payments over 10 years | None | Pays off debt fast, less interest | High monthly payments |

| SAVE (formerly REPAYE) | Residents, PSLF candidates | 5–10% of discretionary income | Yes, after 20-25 years (or 10 with PSLF) | Government subsidizes some interest | Payments may rise with income |

| PAYE | Residents, PSLF candidates | 10% of discretionary income | Yes, after 20 years (or 10 with PSLF) | Payments never exceed standard plan | Interest still adds up |

| IBR (New 2014 Version) | Residents who don’t qualify for PAYE | 10% of discretionary income | Yes, after 20 years (or 10 with PSLF) | More payment flexibility than Standard | Payments may be higher than PAYE |

| PSLF (Public Service Loan Forgiveness) | Doctors working at non-profits | Must be on an IDR plan | Yes, after 120 qualifying payments (10 years) | Tax-free forgiveness, big savings | Requires 10 years of qualifying payments |

| Refinancing | High-income doctors not using PSLF | Depends on new loan terms | None | Can lower interest rates & save money | Lose PSLF & federal protections |

How to Use This Chart

- If you’re in residency, an Income-Driven Repayment (IDR) plan like SAVE or PAYE is usually the best option.

- If you plan to work at a non-profit hospital, PSLF can save you hundreds of thousands of dollars.

- If you want to pay off debt fast and don’t qualify for PSLF, refinancing after residency could save you money on interest.

Step 3: Decide If Refinancing is Right for You

If you don’t qualify for PSLF, refinancing could lower your interest rate and save you thousands.

✅ Refinance If:

- You have a stable attending salary

- You don’t plan to use PSLF or IDR

- You have good credit (700+ score)

❌ Don’t Refinance If:

- You’re pursuing PSLF

- You may need income-driven repayment

- You want federal protections like deferment

📌 How to Refinance:

✅ Compare rates from lenders like SoFi, Laurel Road, and Earnest

✅ Apply online and choose the best offer

✅ Make sure to check for cash bonuses and no fees

💡 Example: Dr. Sarah, a dermatologist, had $300,000 in federal loans at 6.5%. Since she was in private practice, she refinanced to 3.8% and saved $100,000 in interest over 10 years.

Step 4: Make Extra Payments (If You Can)

Even small extra payments can shrink your debt faster.

- Pay biweekly – This creates one extra payment per year.

- Put raises or bonuses toward loans.

- Use an “extra payment” calculator to see how much you’ll save.

💡 Example: Dr. Kevin, an orthopedic surgeon, made an extra $500 payment per month. He paid off his loans 5 years early and saved $50,000 in interest!

Step 5: Avoid Lifestyle Inflation

When you get that first big paycheck, it’s tempting to upgrade everything.

Smart Money Moves Instead:

✅ Keep living like a resident for 2-3 years.

✅ Pay down high-interest debt first.

✅ Invest in retirement accounts early.

💡 Example: Dr. Ashley, an ER doctor, resisted the urge to buy a $1M house immediately. Instead, she rented a modest home, paid off her loans in 4 years, and THEN bought her dream home.

Step 6: Get Expert Help If You Need It

Managing student loans can be confusing. Consider working with a student loan planner or financial advisor who understands physician finances.

📌 Where to Find Help:

✅ White Coat Investor (great blog for doctors)

✅ Student Loan Planner (consulting service)

✅ Your hospital’s HR department (for PSLF help)

Final Thoughts: Take Action Today!

Your student loans don’t have to control your life. With a solid plan, you can pay them off, build wealth, and enjoy financial freedom.

🚀 Start Now:

✔ Log into studentaid.gov and review your loans.

✔ Choose the best repayment plan (PSLF, IDR, or refinance).

✔ Avoid lifestyle inflation and make smart money moves.

You’ve worked hard to become a doctor—now let’s make sure your money works for you!

Ready to protect your future?

Get a personalized side-by-side policy comparison of the leading disability insurance companies from an independent insurance broker.