Story at-a-glance Your practice is your income engine. If you can’t work, both personal and business cash flow stop.Individual disability coverage protects your personal paycheck.Business Overhead Expense insurance keeps rent, staff, and bills paid while you recover.Buy-Sell and Loan

The 7 Biggest Financial Mistakes Doctors Make in Their 30s

Story at-a-glance Your 30s are when your doctor paycheck jumps, but so do money risks (debt, kids, house, lifestyle).Mistake #1: Lifestyle inflation. Fix it with a 3-month reset, clear priorities, and auto-savings first.Mistake #2: Skipping own-occupation disability insurance and term life

Year-End Checklist: 5 Smart Money Moves for Doctors Before December 31st

Story at-a-glance Max out retirement. Hit contribution limits to cut taxes and grow savings.Review insurance. Update disability and life coverage to match your current income.Use health accounts. Spend FSA funds and boost HSA savings.Give smart. Donate strategically to lower taxes and make an

Being Proactive: The #1 Habit for Success as a New Attending Physician

Story at-a-glance Being proactive sets the foundation for career success, especially during your early years as an attending.Proactive doctors focus on what they can control—like schedules, finances, and personal growth.Common challenges like burnout, debt, and poor boundaries can be avoided

Being Proactive: The #1 Habit for Success as a Physician or Dentist

Story at-a-glance Being proactive means taking control, not waiting for problems to happen. Proactive doctors avoid burnout, grow faster, and lead healthier practices and teams. Focus on your “Circle of Influence”—your skills, planning, habits—not outside forces. Small changes, like better

Transitioning to Full-Time Practice: Managing Your New Income

Story at-a-glance Going from residency to practice means a big income jump—but also a big risk of overspending.Create a clear plan for saving, debt payoff, and spending before your first full paycheck hits.Avoid lifestyle inflation—celebrate your success, but don’t overcommit to big purchases

New Year, New Goals: Financial Planning Tips for 2025

Story at-a-glance Start 2025 with a financial check-up: Know your income, debt, and savings to build a smart plan.Set clear goals using the SMART method to stay focused and motivated.Max out retirement accounts and build an emergency fund to protect your future.Review disability and life

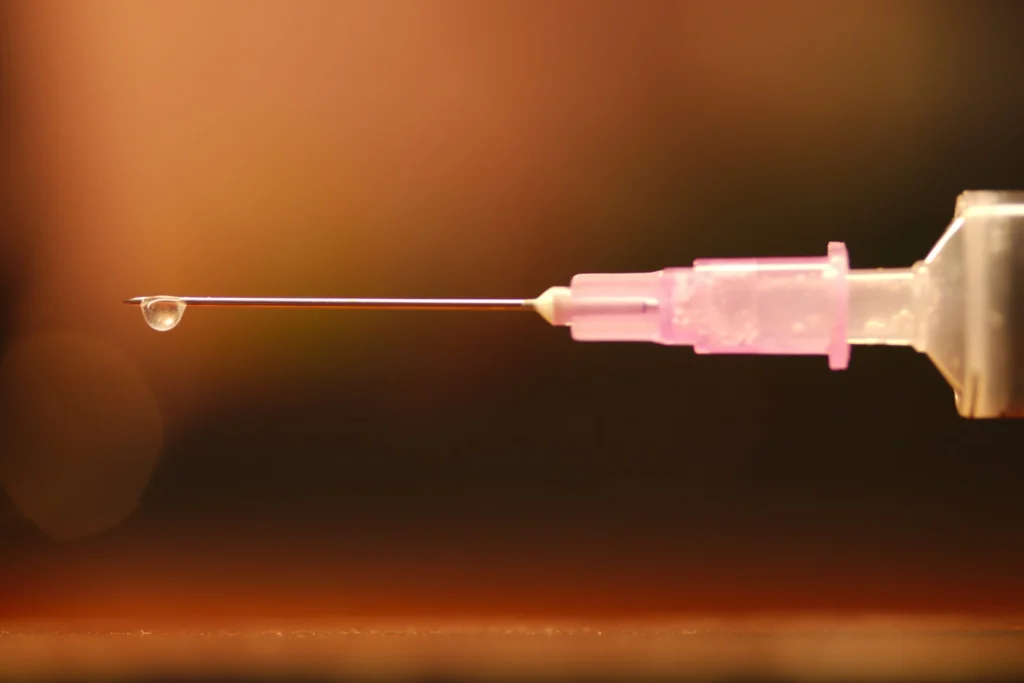

The Financial Consequences of a Needle Stick Injury

Story at-a-glance Needle stick injuries are common—especially in residents, with nearly all surgical trainees affected.Exposure can lead to serious illness like Hepatitis B, C, or HIV—and major financial consequences.Disability insurance protects your income if a health event stops you from