You would be hard pressed to find more than a few intelligent and responsible individuals who wouldn’t agree that planning for the future is one of the most important things we can do as adults, especially where the security of our families are concerned. Yet, astoundingly, 42% of adults over the

Physician Retirement “Gotchas” to Avoid

Unquestionably, physicians are starting to take their retirement planning much more seriously. With life expectancy on the rise, greater economic uncertainty on the horizon, and lowered expectations for long term investment returns, many of us are looking at our retirement with a little more

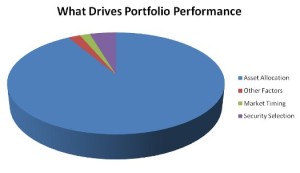

Physician Retirement Plans Benefit from Diversification

As with too many retirement savers, it took two stock market crashes (2001, 2008) and a global financial crisis for Randy Page, M.D. to finally realize that trying to time the market or pick specific stocks or sectors is a costly exercise in futility. But, with the value of his qualified retirement

Physicians Investing too Conservatively

That physicians tend to be risk-adverse and cautious in their approach to investing can work to their advantage. But the same approach, when applied through several market cycles consisting of both market advances and market declines, is less likely to generate the long term returns necessary to

How New Physicians Can Achieve Savings Success

One of the bigger financial challenges for fledgling physicians is staying motivated to keep setting aside a greater portion of their earnings for savings. Saving money, for the sake of savings, while noble and responsible, doesn’t always provide the inspiration physicians need to keep plowing away

Asset Allocation through the Physician’s Life Cycle

Asset Allocation through the Physician's Life Cycle As you age your lifestyle needs change as do your investment outlook and priorities. For most physicians, the longer their time horizon, the more risk they are willing to take in order to achieve better returns on their investments. Then, as their