Story at-a-glance

- Long-term care is costly, and most physicians underestimate future needs.

- Traditional LTC insurance offers more flexibility, but it’s “use it or lose it.”

- Hybrid LTC insurance combines care with life insurance or annuities—no wasted premiums.

- Hybrid policies cost more upfront but give a guaranteed benefit, even if care isn’t needed.

- Choosing the right LTC plan now protects your retirement and legacy.

As a physician or dentist, you spend your career taking care of others, but have you thought about who will take care of you when you’re older?

Long-term care (LTC) is expensive, and many people underestimate how much help they might need later in life. Whether it’s home care, assisted living, or a nursing facility, the costs can drain even a strong retirement plan.

That’s where long-term care insurance comes in. But not all policies are the same. There are two primary types:

- Traditional Long-Term Care Insurance

- Hybrid Long-Term Care Insurance (Life + LTC or Annuity + LTC)

Each has pros and cons, and choosing the right one depends on your financial goals. Let’s break them down.

Traditional Long-Term Care Insurance

What It Is

Traditional long-term care insurance is a standalone policy designed only for long-term care expenses. You pay annual premiums, and if you need care later in life, the policy covers your costs up to a set benefit limit.

How It Works

- You choose how much coverage you want (daily or monthly benefit amount).

- You select a benefit period (how long benefits will last, such as 3, 5, or 10 years).

- There is typically a waiting period (e.g., 90 days) before benefits begin.

- If you never need care, you get nothing back—just like auto or health insurance.

Pros of Traditional LTC Insurance

✅ Lower Premiums Initially – Monthly or annual premiums are often lower than hybrid policies.

✅ Comprehensive Coverage – Covers home care, assisted living, and nursing facilities.

✅ Greater Flexibility – Can be customized with inflation protection and shared care for couples.

✅ Potential Tax Benefits – Premiums may be tax-deductible (especially for business owners).

Cons of Traditional LTC Insurance

❌ “Use It or Lose It” – If you never need long-term care, the money you paid in premiums is lost.

❌ Premiums Can Increase – Insurance companies have the right to raise rates over time.

❌ Stricter Underwriting – You may not qualify if you have pre-existing health issues.

Who Should Consider It?

- You want the most affordable long-term care coverage.

- You’re okay with the risk of not using it (like auto insurance).

- You don’t need life insurance or an annuity.

Hybrid Long-Term Care Insurance (Life + LTC or Annuity + LTC)

What It Is

Hybrid policies combine long-term care benefits with either life insurance or an annuity. This way, even if you never need long-term care, your money isn’t wasted.

Types of Hybrid LTC Policies

Life Insurance with a Long-Term Care Rider

- A permanent life insurance policy (like whole life or universal life).

- If you need LTC, you can use part of the death benefit early to pay for care.

- If you don’t need LTC, your beneficiaries receive the full death benefit.

Annuity with Long-Term Care Benefits

- You invest a lump sum into an annuity that grows tax-deferred.

- If you need LTC, the annuity pays out much more than the original investment.

- If you never need care, you or your heirs still receive the annuity funds.

Pros of Hybrid LTC Insurance

✅ “Use It or Keep It” – If you don’t need LTC, your heirs get a death benefit or annuity payout.

✅ Fixed Premiums – Most hybrid policies are paid upfront or have guaranteed level premiums.

✅ Easier to Qualify – Some hybrid policies have simpler underwriting than traditional LTC.

✅ Cash Value Growth – Whole life policies with LTC riders accumulate cash value.

Cons of Hybrid LTC Insurance

❌ Higher Cost – Hybrid policies often require a larger upfront investment.

❌ Less Flexibility – The LTC benefit is tied to the life insurance or annuity, limiting options.

❌ Lower LTC Benefits – Compared to a standalone LTC policy, a hybrid policy may provide less coverage.

Who Should Consider It?

- You want LTC coverage but don’t want to waste money if you don’t use it.

- You already need life insurance and want to add an LTC benefit.

- You have a large amount of cash and prefer to fund an annuity-based plan upfront.

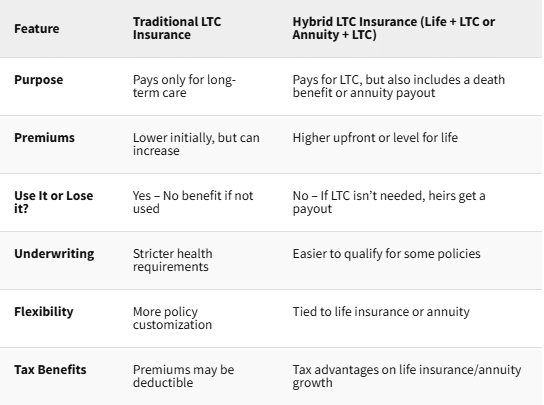

Key Differences: Traditional vs. Hybrid LTC

| Feature | Traditional LTC Insurance | Hybrid LTC Insurance (Life + LTC or Annuity + LTC) |

|---|---|---|

| Purpose | Pays only for long-term care | Pays for LTC, but also includes a death benefit or annuity payout |

| Premiums | Lower initially, but can increase | Higher upfront or level for life |

| Use It or Lose it? | Yes – No benefit if not used | No – If LTC isn’t needed, heirs get a payout |

| Underwriting | Stricter health requirements | Easier to qualify for some policies |

| Flexibility | More policy customization | Tied to life insurance or annuity |

| Tax Benefits | Premiums may be deductible | Tax advantages on life insurance/annuity growth |

Which Type of LTC Insurance Is Right for You?

💡 Choose Traditional LTC Insurance if:

✔️ You want the lowest cost LTC coverage.

✔️ You’re okay with the risk of not using it.

✔️ You prefer customizable benefits (e.g., inflation protection, shared care).

💡 Choose Hybrid LTC Insurance if:

✔️ You want LTC coverage + a life insurance benefit.

✔️ You already need permanent life insurance.

✔️ You prefer guaranteed premiums (no risk of future rate increases).

✔️ You have cash to invest upfront for an annuity-based plan.

Final Thoughts

Long-term care can be one of the biggest expenses in retirement. The key is planning ahead so that you’re not caught off guard.

👉 Step 1: Decide how you want to pay for long-term care—self-funding, insurance, or a mix.

👉 Step 2: Compare traditional and hybrid LTC policies to see what fits your goals.

👉 Step 3: Work with a financial advisor who understands physician and dentist finances.

The right long-term care plan protects your assets, your independence, and your family’s financial future. Whether you choose traditional or hybrid, making a plan today will give you peace of mind for tomorrow.

Ready to protect your future?

Get a personalized side-by-side policy comparison of the leading disability insurance companies from an independent insurance broker.