Story at-a-glance

- Losing a key partner can cripple your practice – Their absence impacts patient care, revenue, and team morale.

- Recruitment takes time and money – Replacing a high-performing physician isn’t fast or cheap.

- You may be on the hook financially – Without planning, you could be paying a salary and dividends to an absent or deceased partner’s family.

- Key person insurance bridges the gap – It provides funds to replace income, hire help, and protect the business.

- Protects everyone involved – Your practice, your partners, and your partner’s family.

This could happen to you: You are a successful physician in private practice, living your dream. You have a terrific bunch of partners, and a skilled and diligent office manager who keeps the whole practice humming along. But early one morning you get a call from distraught family member: There’s been an accident. Your key partner – a workhorse of a doctor who takes on a substantial patient load and whose leadership, experience and management skills are essential to the functioning of your business – is in the ICU, and isn’t expected to make it. What happens now?

Questions to Ask Yourself

- If this happened to you and your practice, would some of your partner’s patients leave the practice and find new doctors?

- Will your practice be closed or functioning at reduced capacity for any length of time? What will that cost in terms of lost income?

- Do you have another physician in the same specialty ready to take on the load, in addition to his or her current load, immediately?

- What would it cost to recruit and hire a new physician to see your partner’s patients? How long will it take to bring this person on board?

- Can you pay your partner’s dividends even though he’s no longer contributing to the business?

- If the partner is deceased, can you continue to pay dividends to your partner’s spouse/heirs even as you pay a salary to a replacement?

The answer, of course, differs for every business. But it is clear that in any busy medical practice, if one partner dies or becomes disabled and unable to contribute, the remaining partners will take a big financial hit.

The spillover effect could even force you to lay off valuable staff.

Insurance Planning

This is why insurance planning isn’t limited to your own point-blank personal disability and life insurance policies. You also have to consider risk management for the practice as a whole, since the death or disability of a partner or key individual could endanger the financial security of all the other partners individually and the practice as whole.

In many cases, the practice will own its own insurance policy on each of the individual partners, and any key individuals the partners select. In the case of the insured’s death, the life insurance policy will pay a death benefit to the business. This provides the business with enough cash to keep functioning long enough to hire a replacement, as well as purchase the deceased partner’s share of the business back from the heirs. This is important, because otherwise your partnership or corporation could be paying dividends to your deceased partner’s heirs forever, though they aren’t contributing to the profits of the business.

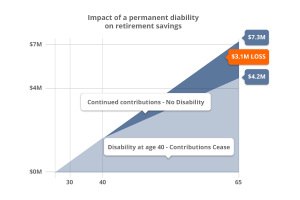

If the partner is disabled, then a company-owned disability insurance policy will pay out either a lump sum or a set monthly income benefit for as long as your partner qualifies as disabled. This may help you recruit and hire some help while your partner recovers, or provide enough liquidity to buy out your partner’s share of the business.

Key man insurance is a vital part of business succession and continuation planning.

Ready to protect your future?

Get a personalized side-by-side policy comparison of the leading disability insurance companies from an independent insurance broker.