Story at-a-glance

- 1 in 4 physicians will face a disability that interrupts their ability to work for 3 months or more.

- A young doctor, just out of residency, protected her future $7–10 million in earnings with a private policy.

- Less than a year later, she was diagnosed with a brain tumor and could no longer work.

- Her disability policy kicked in, replacing a large portion of her income while she undergoes treatment.

- Disability insurance isn’t just a cost—it’s peace of mind when life takes an unexpected turn.

Most people who get as far as receiving a quote from a disability insurance site see the price of the policy. But it’s important to understand the value of a disability insurance policy as well. The fact is that one in four of you reading this will struggle with a disability disrupting your ability to work for three months or more – and sometimes that disability strikes tragically early in life.

Here’s something that occurred recently, to one of our own clients, a promising young doctor, just like many of you.

1 Year Out of Residency

Susan was in her last year of residency when she began wondering about disability insurance. Working with our agent, she calculated her expected future earnings as a doctor at around $7-10 million—not far from the average. Although money was still tight that year for her and her family, she decided to protect that income against the risk of disability, and bought a high-quality policy from us.

After all, she saw disabilities among women every week, in the course of practicing medicine: pregnancies issues and complex deliveries requiring extensive bed-rest, and months away from their jobs.

Some of these women depended on their jobs not just for medical insurance, but also to put food on the table. Some of her patients were put in a tight spot, with no real safety net for them other than Medicaid.

The Timeline: Why Timing Was Everything

- 📅 Residency Year 3: Susan applies for coverage. Healthy, no symptoms. Locks in "In-Training" discount.

- 📅 Month 1 Post-Residency: Policy is in force. Premium is locked.

- 📅 Month 10 Post-Residency: First symptoms (dizziness/headaches) appear.

- 📅 Month 12: Diagnosis (Brain Tumor). Uninsurable from this point forward.

- ✅ Result: Full benefit payout. Without the policy from Year 3, she would have $0 income protection.

"What happened to them could happen to me"

“What happened to them could happen to me,” she thought, and so bought a disability policy with us that would protect up to 60 percent or so of her income.

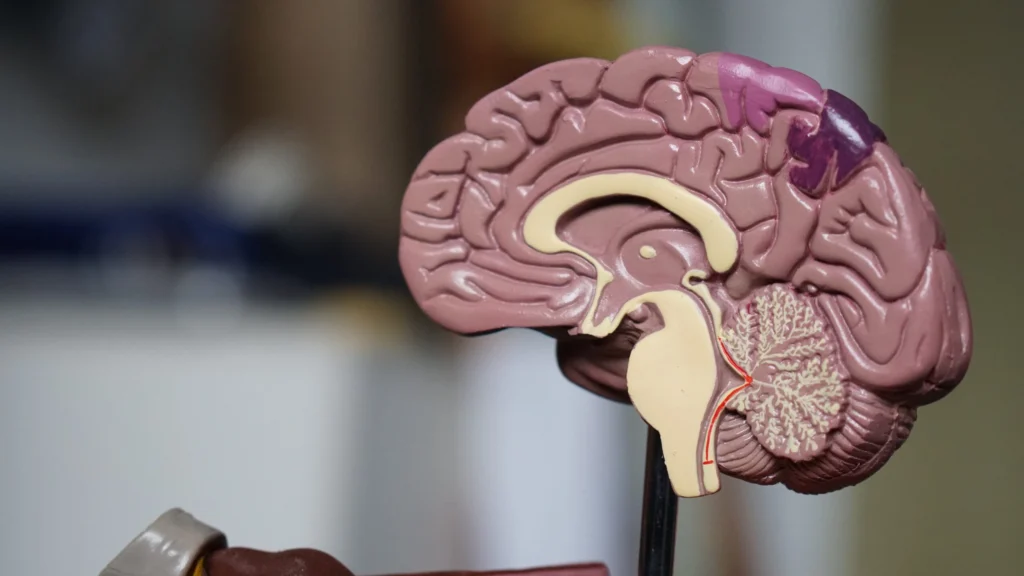

Less than a year later, Susan began suffering dizzy spells and unexplainable headaches. She went to see a specialist, who did some scans. The result: Susan was suffering from a brain tumor.

The combination of the tumor’s symptoms and treatment side effects, coupled with the time and travel required for her to seek treatment, made it impossible for her to continue working.

Monthly Benefit

She called us, and we initiated a claim. She is currently still receiving a monthly check from her disability carrier, to replace most of her lost income, and still in treatment for the brain tumor. While she’s fighting to beat the tumor and regain her life, she is thankful every day that she took the time to protect her income—one less thing she needs to focus on now.

⚠️ The "Wait and See" Gamble

Many residents think, "I'll buy insurance once I'm an attending and making real money." Susan's story proves why this is a dangerous gamble.

If Susan had waited just 12 months to apply, her diagnosis would have made her permanently uninsurable. By securing coverage during residency, she protected a future asset worth over $10 million. Your health is your most fragile asset—lock it in while you have it.

Ready to protect your future?

Get a personalized side-by-side policy comparison of the leading disability insurance companies from an independent insurance broker.