Finding Work-Life Balance as a Physician or Dentist: A Guide Using Zig Ziglar’s Wheel of Life

If you’ve been an attending physician or practicing dentist for several years now, you’ve built your career, established a steady income, and gained more control

Do I Really Need Disability Insurance Now?

As a resident physician, you’ve got plenty on your plate—long shifts, mounting student loans, and the pressures of training. With so much going on, it’s

Finding Work-Life Balance as a Soon-to-Graduate Medical Resident: A Guide Using Zig Ziglar’s Wheel of Life

Medical residency is intense. Long hours, high stress, and little time for anything outside of work can make it feel impossible to find balance. But

Transitioning to Full-Time Practice: Managing Your New Income

The Shift in Income Transitioning from residency or fellowship to full-time practice comes with a major increase in income. While it’s exciting, this is also

How to Save for Retirement While Managing Student Loans

Hi, I’m Chuck Krugh, a Certified Financial Planner (CFP) with years of experience helping medical professionals navigate their unique financial challenges. One of the most

Avoiding Burnout in 2025: Self-Care for Busy Professionals

As the demands of work and life continue to grow, burnout has become a common challenge for busy professionals. Physicians, dentists, and other high-achieving individuals

New Year, New Goals: Financial Planning Tips for 2025

The start of a new year is the perfect time to press reset, reflect on your progress, and set new financial goals. For physicians and

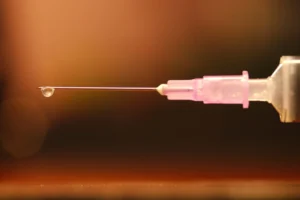

The Financial Consequences of a Needle Stick Injury

Needle sticks are a common injury among medical personnel – and they can be especially prevalent with young resident doctors. Although a needle stick can

What is Guaranteed Standard Issue (GSI) Disability Insurance, and Why Should Medical Residents and Fellows Care?

If you’re a medical resident or fellow, GSI could be a game-changer when it comes to protecting your income—and it’s a solution that doesn’t require

How Do I Choose the Best Disability Insurance Company?

When it comes to disability insurance, the company you choose is just as important as the policy itself. After all, this is the company you’ll

How Do I Choose the Best Disability Insurance Policy?

As a doctor, protecting your income is one of the most important steps you can take for your financial future. Disability insurance ensures you have

What is “Guaranteed Renewable and Non-Cancelable” Coverage, and Why is it Important for Doctors?

When you invest in disability insurance, you’re not just buying a policy—you’re buying peace of mind. But not all policies offer the same level of