Story at-a-glance

- Emergency medicine requires physical readiness, mental clarity, and fast decisions—any change in these areas can end your career.

- Musculoskeletal injuries, cognitive fatigue, and exposure to trauma or violence put emergency physicians at higher risk of disability.

- Standard disability coverage doesn’t match the shift-based, high-pressure nature of ED work.

- You need true own-occupation coverage.

- A claim could protect over $10 million in future income—apply while you’re still healthy.

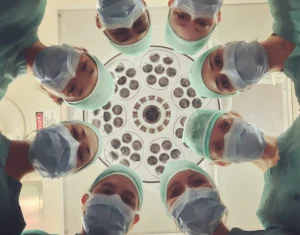

In the high-stakes world of emergency medicine, you make split-second decisions that save lives. Your ability to maintain mental clarity during chaotic situations, physically maneuver through crowded trauma bays, and perform critical procedures under pressure defines your career. Yet these same essential capabilities face unique threats that make specialized disability protection not just advisable—but critical—for emergency physicians. Here’s why your specialty demands disability insurance for emergency medicine physicians to protect your future.

The Distinctive Risks of Emergency Medicine Practice

The ED environment creates disability vulnerabilities unlike any other medical specialty:

Musculoskeletal Injuries: The Procedural Price

Emergency medicine demands physical readiness for critical procedures and rapid responses. From CPR and intubations to managing combative patients, your work puts tremendous strain on your body. Back injuries from procedural positioning, shoulder injuries from repetitive motions during resuscitations, and neck strain from prolonged focus during critical cases are occupational hazards. Unlike some specialties where adjustments might accommodate physical limitations, emergency medicine’s unpredictable demands require consistent physical capability across all shifts.

Cognitive Fatigue and Mental Health Challenges

The relentless pace and emotional intensity of emergency medicine create extraordinary psychological pressures. Constantly shifting from trauma to cardiac arrest to pediatric emergencies—often within minutes—requires exceptional cognitive agility. Post-traumatic stress, anxiety, and depression affect emergency physicians at disproportionate rates. These conditions can progressively impair the emotional regulation and decision-making capacity essential for managing the unpredictable flow of emergent cases.

Infectious Disease Exposure

Emergency physicians serve as healthcare’s front door, encountering patients before diagnoses are established. This creates heightened exposure to infectious agents, from respiratory pathogens to bloodborne diseases during trauma resuscitations. Beyond acute infections, long-term complications from occupational exposures can cause progressive limitations in stamina and cognitive function—essential qualities for the demanding rhythm of emergency shifts.

Circadian Disruption Complications

The rotating shift schedule fundamental to emergency medicine creates unique health vulnerabilities. Night shifts, rapidly changing schedules, and insufficient recovery time between shifts contribute to elevated rates of cardiovascular disease, metabolic disorders, and sleep disturbances. These conditions can progressively limit your capacity to safely manage the cognitive and physical demands of emergency medicine long before retirement age.

Violence and Physical Trauma

Emergency physicians face heightened risks of workplace violence compared to most medical specialties. Physical assaults from patients or family members can cause career-altering injuries that limit your ability to perform essential emergency medicine functions. A single violent encounter can lead to permanent disabilities that end an otherwise promising career.

⚠️ The ER "Gotcha": The Mental/Nervous Limitation

Emergency Medicine physicians face unparalleled rates of burnout, PTSD, and severe anxiety due to the trauma they manage daily. Insurance companies know this.

The Fine Print: Most standard group and individual policies include a 24-Month Mental/Nervous Limitation. If your disability is psychological rather than physical, they will cut off your benefits after just two years. When designing a policy for an EM physician, it could be beneficial to shop the market for carriers that offer the most favorable mental health terms and definitions.

Why Standard Coverage Leaves Emergency Physicians Vulnerable

Hospital-provided disability insurance typically has critical limitations for emergency medicine practice:

- Generic definitions of disability that don’t recognize the unique physical and cognitive demands of emergency medicine

- Benefit caps that fail to adequately replace high emergency physician incomes

- Insufficient protection for occupation-specific functions like procedural skills

- Taxable benefits that further reduce actual income replacement

- Coverage tied to specific employers, limiting career flexibility

Disability Insurance for Emergency Medicine Physician: Critical Components

Specialized Own-Occupation Definition

As an emergency medicine physician, you need a policy with a True Own Occupation definition of disability that protects your specific occupation. This ensures you’ll receive benefits if an injury or illness prohibits you

from performing the specific duties of your occupation —even if you could work in a different occupation or medical specialty.

Robust Financial Protection

Given the physically demanding nature of emergency medicine, look for companies with the strongest financial ratings (Comdex score of 90+) and mutual ownership structures. Your disability policy may need to provide benefits for decades—financial strength ensures the company will remain solvent throughout your potential claim period.

Emergency Medicine-Specific Features

Prioritize these critical policy elements:

- Residual/partial disability benefits that recognize reduced capacity to work overnight shifts

- Coverage for occupation-specific activities like intubations, central lines, and rapid procedures

- Student loan protection riders for recent graduates still carrying significant educational debt

- Provisions that recognize the shift-based nature of emergency medicine practice

The Shift-Worker's Dilemma: How Residual Coverage Saves You

In the ED, you rarely become "100% disabled" overnight. Instead, a bad back or chronic fatigue might force you to drop your shift count from 14 per month down to 8. Here is how an Enhanced Residual Disability Rider protects your income when you can only work part-time:

| Scenario | Shifts per Month | Earned Income | Tax-Free Residual Benefit Paid |

|---|---|---|---|

| Pre-Disability (Healthy) | 14 Shifts | $30,000 | $0 |

| Partial Disability (No Rider) | 8 Shifts | $17,100 | $0 (Claim Denied) |

| Partial Disability (With Rider) | 8 Shifts | $17,100 | ~$5,000+ (Fills the Gap) |

*If you lose more than 15-20% of your income due to a physical limitation, the Residual rider kicks in to subsidize your lost shifts. (Depending on the company, the definition/percentages may differ)

The Financial Reality of Disability

The financial stakes are immense. A 35-year-old emergency physician earning $350,000 annually could lose over $10.5 million in lifetime earnings if permanently disabled. Yet many emergency physicians resist disability insurance premiums of $350-$600 monthly—far less than what they spend protecting homes and vehicles.

Consider this reality: If sudden back injury prevented you from performing CPR, or progressive anxiety made managing multiple critical patients simultaneously impossible, how would you maintain your family’s financial security? What alternative career path could replace your current income without requiring the procedural skills and stress tolerance that emergency medicine demands?

Choosing Between Policy Options

When comparing disability policies, emergency physicians should focus on these key differentiators:

- Definition of disability specific to your own occupation

- Financial strength ratings of the insurance carrier

- Portability as your career evolves

- Occupation-specific provisions addressing ED work patterns

Many emergency physicians find that paying more for premium coverage from financially strong carriers provides essential peace of mind. When evaluating options, remember that saving a few hundred dollars monthly on something this crucial is shortsighted given the decades of benefits potentially at stake.

Secure Your Future Today

The optimal time to secure disability insurance for emergency medicine physicians is now—while you’re healthy and before any conditions develop that could limit your coverage options. Many emergency physicians delay this protection until physical complaints or burnout symptoms emerge—when it’s often too late to obtain favorable coverage.

Request your personalized disability insurance quote comparison today by clicking the button below. Our team specializes in disability coverage for emergency medicine physicians and can help you understand the crucial differences between policies that could significantly impact your future security.

Your ability to practice emergency medicine represents your most valuable financial asset—don’t leave it unprotected. The same decisiveness you bring to the ED should apply to protecting your career and financial future.

Ready to protect your future?

Get a personalized side-by-side policy comparison of the leading disability insurance companies from an independent insurance broker.