Story at-a-glance

- A disability can stop your income—and your retirement savings.

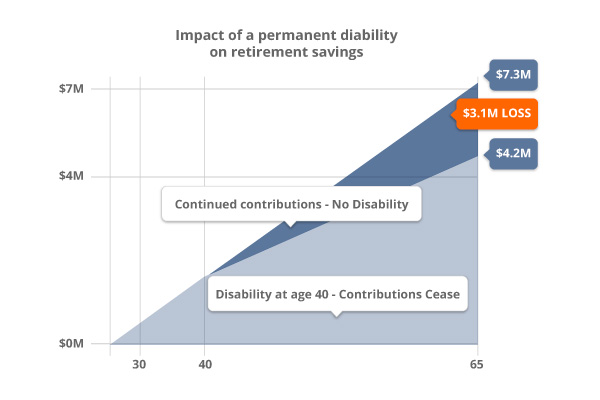

- Losing the ability to contribute could mean a 42% drop in what you’ll have at retirement.

- Retirement Protection Disability Insurance fills that gap, continuing contributions if you become disabled.

- Benefits go into a trust and grow until age 65, helping you stay on track.

- It’s portable, tax-free (when paid post-tax), and ideal for individuals or employee benefit programs.

What would happen to your ability to save for retirement if you were hurt or too sick to work? Most people in this situation, with no income and increased medical bills, are forced to use their savings to meet everyday living expenses. It’s important to put a fallback plan in place to ensure that money continues to be put away for your retirement even if you become disabled.

Can you afford a 42% loss to your retirement savings?

A permanent disability could disrupt your retirement savings, as shown here. If you can’t make contributions to your retirement plan, your retirement dreams may not become reality.

Retirement Protection Disability Insurance helps you continue saving for retirement in the event of a disability. If you become disabled, the policy pays a benefit in the amount of your retirement plans monthly contribution into a special trust. The money in the trust is invested at your discretion until you reach age 65 and then distributed to help supplement your retirement income. It is not a pension plan. Rather, it is a program that provides disability income insurance to ensure your ability to make retirement plan contributions until the age of 65.

The goal: to provide you with close to what you could have expected from the retirement plan if you had not become disabled. In addition to protection for your own retirement, it also makes an excellent benefit for select employees – or your entire staff.

Retirement Protection Disability Insurance Features:

- Monthly benefits up to $3,800/month

- Coverage can be added to an existing individual or group disability insurance plan to cover more of your annual income

- Non-cancelable, guaranteed renewable coverage to age 65, which means your policy cannot be changed or canceled except for non-payment of premiums

- Portable, individually-owned coverage

- Tax-free benefits (when premiums are paid by the insured with after-tax dollars; investment earnings within the Trust are taxable)

FAQs

What is Retirement Protection Disability Insurance?

It’s a policy that continues your retirement contributions if you become too sick or hurt to work. It helps protect your long-term financial future—even if your income stops.

How does it work?

If you’re disabled, the insurance pays monthly benefits into a special trust. That money is invested until you reach age 65, then paid out to support your retirement.

How much can I get?

The plan offers up to $3,800/month in contributions to replace what you would’ve saved if you had not become disabled.

Is it the same as a retirement plan or pension?

No. It’s not a retirement plan. It’s a disability insurance policy designed to keep your retirement savings on track if you can’t work.

Can this be added to my current disability policy?

Yes. It’s often added to an existing group or individual disability insurance plan to cover income that’s not protected by standard policies.

Is the policy portable?

Yes. It’s individually owned, so you keep it if you change jobs or move to a new practice.

Are the benefits taxable?

The monthly contributions are tax-free if you pay your premiums with after-tax dollars. However, the investment earnings in the trust may be taxed when distributed.

Ready to protect your future?

Get a personalized side-by-side policy comparison of the leading disability insurance companies from an independent insurance broker.