Story at-a-glance

- Term life offers low-cost, temporary coverage, but only pays out about 1% of the time—and premiums rise sharply if renewed after the term ends.

- Permanent life (like whole life) guarantees lifetime coverage, builds cash value, and pays out 100% of the time—as long as premiums are maintained.

- “Buy term and invest the difference” sounds good in theory, but requires discipline, consistent investing, and favorable market returns—none of which are guaranteed.

- Permanent policies cost more, but offer lasting protection and tax-advantaged cash accumulation.

- The best life insurance is the one that fits your long-term needs, budget, and gives your family certainty when it matters most.

With their unique financial needs, and with so much at stake, physicians need to have a thorough understanding of how the two primary forms of life insurance work. All of the various forms of life insurance – whole life, term life, variable life, universal life and the dozens of variations of each – can be distilled down to just two types: Term and Permanent. So, what’s the best life insurance for physicians? You need the facts before you decide.

Term Life Insurance

Because of its lower premium, term life insurance is a popular choice for physicians who believe it can provide the greatest protection at the lowest overall cost. While that may be true if you knew when you were going to die, it doesn’t necessarily hold true if you die closer to the age that the insurance company expects you to die.

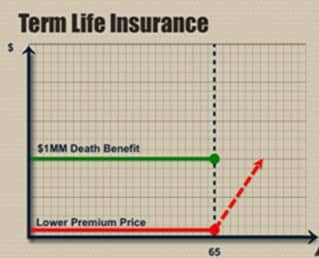

As the graphic illustrates, a level term policy can provide a level death benefit for a certain period of time – i.e., to age 65, 10 years, 15 years or 30 years – after which everything your premium stops and your death benefit stops. If, at the end of that period of time, you still have a need for life insurance protection, you would have to renew the coverage at a much higher rate, often prohibitively high; that is if you are still insurable.

The bottom line is that term life insurance is not designed to pay off. The life insurer knows that the likelihood of your dying before your life expectancy is very low.

In fact, statistically, there is only a 1 percent likelihood that a death benefit is paid during the term. That is why life insurers can charge so little for term policies. You have much better odds of a payout at the black jack tables. In Las Vegas, the house is willing to give you a 49 percent chance of winning because it knows it will take in a 2 percent profit at the end of the day. Life insurers are willing to provide you with a million dollars of protection at a fraction of the cost because it knows it will only payout 1 percent of the time.

Permanent Life Insurance

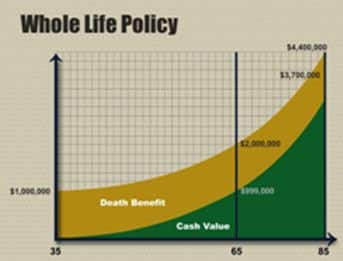

Permanent life insurance, also referred to as whole life insurance, is designed to provide protection for your whole life. As long as the premium payments are made, it will continue to provide protection and it can never be cancelled. As the graphic illustrates, a typical whole life product starts out providing a level death benefit that, when a level premium is paid over time, will increase. This is due to the cash value element of whole life which guarantees a minimum rate of growth on the portion of the premium that isn’t applied to the cost of insurance.

In this example, based on an actual life insurance illustration, the death benefit increases to $2 million as the cash value accumulation grows to nearly $1 million at age 65. Because there has to be a certain space between the cash value and the death benefit, the cash value growth automatically pushes the death benefit higher. In essence, the whole policy provides a continuous expansion of capacity while you are alive (use of the cash value) until the time of your death.

To accomplish this, life insurers charge more for whole life coverage, primarily because, unlike term life which only pays out 1 percent of the time, whole life pays out 100 percent of the time. So, the difference in cost is significant. For a $1 million term life policy a healthy 35 year old physician might pay around $700 a year. The same person would have to pay around $12,000 more for a permanent, whole life policy. This is where the “buy-term-and-invest-the difference” advocates come in.

Buy Term and Invest the Difference?

Why wouldn’t you take the extra $12,000 and invest it on your own? The theory being that, when your term policy expires, you would have accumulated enough capital to provide the capacity you and your family needs. In theory, that might be a reasonable plan. In practice, however, not only do you need to have the discipline to invest the difference as required, you would need to be able to achieve a level of return on your investment that may or may not be available in the markets. That means you have no guarantee whatsoever of accumulating the necessary capital.

The Best Life Insurance for Physicians

In the end, the best life insurance for physicians is the type that is most suited for their specific financial situation. More importantly, it’s the type that will be their when it’s needed most.

Ready to protect your future?

Get a personalized side-by-side policy comparison of the leading disability insurance companies from an independent insurance broker.